NO HIDDEN MESSAGES –

EVERYTHING YOU NEED TO KNOW ABOUT THE TRUTH of ASSET PROGRESSION

What is Asset Progression?

ASSET:

- A useful or valuable thing, person, or quality

- Property owned by a person or company, regarded as having value and available to meet debts, commitments, or legacies:

PROGRESS: Developing towards an improved or more advanced condition.

ASSET PROGRESSION: To progress in your assets is to advance to a better space or position so that the value of that valuable thing/s you have will continue to grow positively. In short, to make sure you are not losing money but instead, you are making money as you own the property.

Why Asset Progression?

The Basic Retirement Sum (BRS) for Singaporeans who turn 55 in 2022 is $96,000. This makes the Full Retirement Sum (FRS) to be $192,000. For those turning 55 five years from now in 2027, your FRS would be $228,000.

At the rate it is going, the projections for FRS in 2050 would be $500,000!

Source: www.cpf.gov.sg

The government is signalling all of us to have enough for us to retire comfortably and debt-free.

The desire to possess a piece of real estate in Singapore is in practically every Singaporean’s blood. And did you know that nearly one out of every five property buyers in Singapore is a Singapore permanent resident or a foreigner?

Despite the ups and downs in property prices throughout time, these factors above have positioned Singapore homes on a long-term price rise path.

Singapore property purchasers and investors have been able to take advantage of these trends to lock in high gains from price growth, en-bloc sales, and passive rental income from their homes.

Earnings from real estate investments are frequently factored into Singaporeans’ retirement plans. For some, it’s a critical component.

Quick Reflection

- Is your property’s net worth able to meet all the debts you have (if you still have loans)? What if there is a way for you to shorten your property loan?

- If you have fully paid off your property, is it still helping you to make money? Or is it losing value which will in turn make you suffer from a ‘negative net worth’?

I am not just talking about buying the right property. I am talking about having the RIGHT PROPERTY PLAN. A P.E.S.S Plan that:

- Ensures PROTECTED CPF

- Help us have EXTRA CASH SAVINGS

- Has been executed by many SUCCESSFUL cases

- Is STABLE and can withstand pandemics as well as the world’s financial instabilities

What people say about Asset Progression

Let’s correct what they say!

1. You MUST UPGRADE to BIGGER houses or private property. WRONG

You may also embark on Asset Progression if you move from an 5rm to a 4rm HDB, or from and EM to a 5rm.

How so? Because you earn from the sale, and your CPF OA (which is also an asset) continues to grow.

In fact, some people can even move on to buying one FULLY PAID HDB and a commercial or private property. So who says you MUST UPGRADE to bigger houses or private property?

2. Only for those with a lot of money. WRONG

Many do not have spare cash and savings, but managed to grow in their net worth the moment they sell their house. But do not do this before you speak to someone who can really plan your property portfolio.

Watch my testimonial video below and click on this link later to see REAL PEOPLE embarking on Asset Progression without touching their cash savings. In fact, after they do it, they have SPARE CASH and SPARE CPF OA for rainy days.

3. Something that requires you to move many times, from one property to another, within a few years. WRONG

Reality Check: Long gone are the days where you should buy your first property and make that your ONLY property. The HDB website used to state that HDB flats are an investment. Today, they remind us that their mission is to ensure housing remain affordable for Singaporean.

So do we need to move many times to ensure our asset grows? Not really. But you MUST move at least once or twice in your lifetime here. More importantly, it is to know how to make your money work harder for you, and to ensure it is parked in a property that help you to grow your net worth.

4. Only for the highly educated, managers and directors in their 40s and above. WRONG

My clients who have embarked on Asset Progression may not ALL have the paper qualifications or ranks in the corporate ladder. But it is their desire to progress and their sincere efforts to find out how they can grow their wealth through property that landed them in very good positions now where in comes to regarding your property as an investment.

And seriously, do not take this from me. Hear from them yourselves through my videos.

What is Sell 1 Buy 2?

Sell 1 Buy 2. Is this the strategy for you?

What is sell 1 buy 2?

The idea behind the strategy is for a couple to sell the current property they are currently living in and buy 2 properties – each under their own name.

4 keys criteria for successfully executing this strategy.

- Dual income household

- Able to secure a tenant for the 2nd property

- Sufficient funds for the 25% down-payment

- Able to meet higher home-loan obligations.

What are the benefits of this strategy?

In an ideal scenario, a couple executing this strategy would be able to:

- Upgrade 2 properties

- Own 2 properties

- Receive rental cashflow

- Avoid paying any ABSD

- Avoid coming up with large down payment given the 75% LTV.

As a bonus, they would also be able to sell off that 2nd property later in life if need be, such as for funding their retirement.

4 keys question to examine the risk of this strategy.

- Do we have a reserve fund for rainy days

- Can we pick a good investment property?

- How much of our monthly income will the home loan instalment consume?

- How much cash do we have on hand and in our CPF acct?

Dear Homeowners,

if you’re looking to start investing in your property, let me share with you the best financial savvy way to do it!

Asset Progression Starter Guide

How to embark on asset progression?

Asset Progression through property investment is NOT a numbers game.

Do NOT take risks.

Prepare all these figures before exploring your options

- CPF OA used

- CPF Accrued interest

- Current outstanding loan

- CPF OA balance

- Income (monthly)

Pro Tips: Get your number ready before you speak to your trusted asset progression advisor. It will really save your time.

Common Mistakes Property Owners Make

Mistake #1 – You own a HDB and do nothing with it.

In Singapore, what does homeownership entail?

- A shelter for your family

- A long-term investment

Common Mistakes Property Owners Make

Mistake #2 – Selling existing HDB flat and buying an old HDB at high price.

Why people do that?

- SERs opportunity

- Stay near parents

- HDB grants

Common Mistakes Property Owners Make

Mistake #3 – Sell existing HDB flat and over commit to another property.

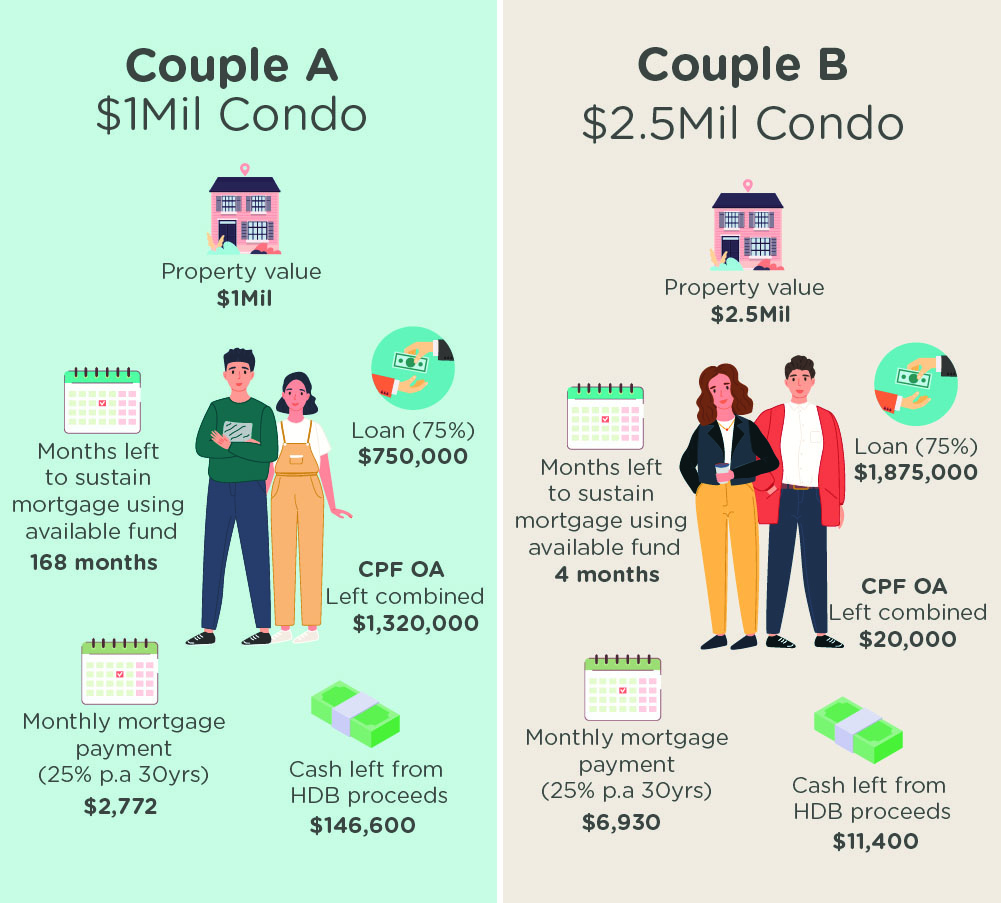

Case study

couple A- sold 5rm HDB $560K – bought condo $1Mil

couple B – sold 5rm HDB $560K – bought condo $2.5Mil.

Both husband and wife – 35yrs old

monthly income combine – $14,200

cash proceeds from sale of HDB flat – $221K

CPF OA acct balance combined – $520K

One day, both couple lose their jobs

How long can both couples fund their mortgage payments using all available funds?

The C.A.R.E Strategy

It may sound too good to be true but there have been many successful cases.

And as we speak, many are either embarking on it at this very point or they are enjoying the fruits of their properties.

We do this with C.A.R.E. Strategy.

Calculations

This is the first and most important thing. It is not just about being able to sell and earn profits.

Affordability

Get your agent to do an affordability matrix for you. It compares all your options and it has a mortgage plan.

Risk

Embarking on Asset Progression need not involve any risks.

Exit Plan

Like they say. ‘begin with an end in mind’. How long do you intend to stay in your next property?

Let’s have a chat shall we?

I will share with you the facts and figures, all from the bottom of my heart. NO HIDDEN MESSAGES.

Whether it is buying or selling your HDB or Private Property; to upgrade, right-size or plan for retirement, I will share strategies that will work for you.